In today’s fast-paced retail world, every sale, return, and transaction flows through a Point of Sale (POS) system. At the core of this system is POS invoice verification — the essential process of ensuring that every invoice generated matches the actual sale, is accurate, and is compliant with tax regulations.

This comprehensive guide covers everything you need to know about POS invoice verification, including FBR invoice verification online, PRA, SRB, and app-based methods. You’ll learn step-by-step techniques, real-life anecdotes, and actionable tips to protect your revenue, streamline operations, and maintain customer trust.

FBR Invoice Verification Online: How It Works

FBR Invoice Verification Online is a service provided by Pakistan’s Federal Board of Revenue (FBR) to validate invoices generated through registered POS systems. It helps businesses:

- Ensure tax compliance

- Detect fraudulent invoices

- Maintain accurate accounting records

For example, small retailers often use this system to reconcile tax invoices with actual sales. This verification protects your business from penalties and reduces errors in VAT or GST reporting.

Step-by-step guide for FBR verification online:

- Export POS invoices from your system.

- Navigate to the FBR online portal.

- Enter invoice details or scan the FBR Invoice Verification QR code.

- Confirm invoice authenticity.

- Archive verified invoices for audits.

PRA Invoice Verification: Ensuring Provincial Compliance

For businesses operating in Punjab, the Punjab Revenue Authority (PRA) mandates invoice verification for proper tax compliance.

PRA invoice verification ensures:

- Correct sales tax calculations

- Accurate invoice numbers and dates

- Proper reporting for audits

Many retailers use integrated POS systems to automatically submit invoices to PRA, reducing human error and making reconciliation seamless.

FBR POS Invoice Verification Lucky Draw: Boosting Compliance Incentives

Pakistan’s FBR occasionally runs FBR POS Invoice Verification Lucky Draw campaigns to encourage taxpayers to register invoices digitally. Participating in the lucky draw:

- Motivates businesses to maintain accurate POS invoices

- Rewards customers and retailers for verified transactions

- Promotes transparency and tax compliance

An anecdote: A café owner in Karachi doubled customer visits during a lucky draw campaign, as clients preferred transactions that were eligible for prizes. This demonstrates how verification not only ensures compliance but can also drive sales.

POS Invoice Verification Online: Streamlining Everyday Checks

POS invoice verification online is not limited to government compliance. Retailers can use online verification tools to:

- Quickly match invoices to transaction logs

- Detect duplicate or missing invoices

- Validate discounts, taxes, and totals

For example, a boutique using POS invoice verification online caught a recurring 5% discount error, preventing a $1,200 monthly loss. The online tools made verification faster and easier than manual audits.

FBR Invoice Verification QR Code: Instant Validation

Many invoices now include a FBR Invoice Verification QR code. Scanning this code instantly confirms:

- Invoice authenticity

- Tax compliance status

- Transaction details

Retailers and customers alike benefit from QR-based verification because it reduces manual errors and ensures accurate records for audits.

FBR Invoice Verification App: Mobile Solutions for Businesses

The FBR Invoice Verification app enables retailers to:

- Scan invoices on the go

- Verify tax compliance instantly

- Maintain accurate digital records

This mobile-first approach is ideal for small businesses or multi-location operations, eliminating the need for constant desktop access.

SRB PoS Invoice Verification: Sindh Revenue Authority Compliance

Retailers operating in Sindh must follow SRB PoS Invoice Verification regulations. SRB verification:

- Confirms tax invoice authenticity

- Detects fraudulent or duplicate invoices

- Simplifies monthly and yearly reporting

A practical tip: Schedule weekly SRB verification to identify discrepancies early, preventing penalties and financial stress.

Tax Invoice Verification: The Ultimate Check for Accuracy

Tax invoice verification ensures your business records are accurate and compliant, protecting against:

- Fraudulent transactions

- Misapplied discounts or taxes

- Audit discrepancies

Businesses that implement regular tax invoice verification often discover hidden errors or inefficiencies — like inventory mismatches or misapplied pricing — that otherwise go unnoticed.

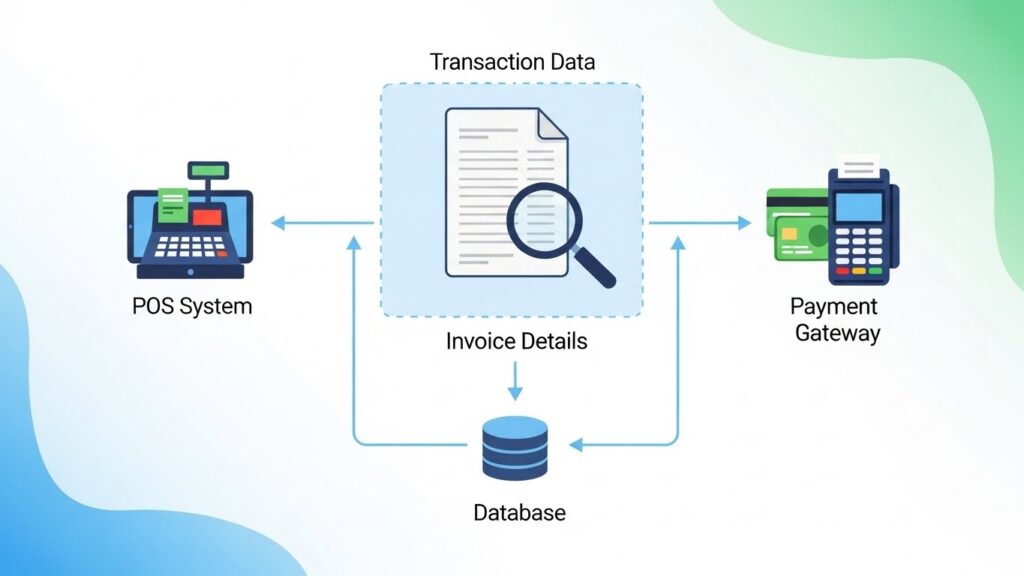

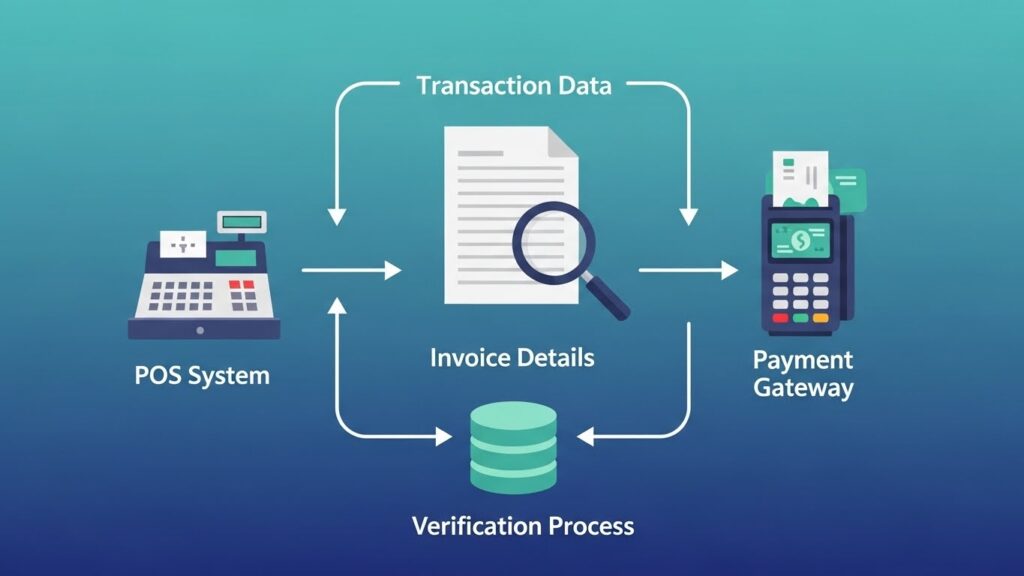

Step-by-Step POS Invoice Verification Process

Here’s a simple, universal workflow for businesses:

- Export POS invoices daily from your system.

- Verify invoice fields: invoice number, totals, taxes, discounts, and payment modes.

- Match with transaction logs for each sale.

- Check inventory movement: sold items should match stock deductions.

- Confirm payment settlement: cash, card, and online payments.

- Flag or approve invoices: errors get reviewed; verified invoices are archived.

- Store and archive verified invoices for audits.

By following this process, your business can prevent losses, improve operational efficiency, and stay fully compliant.

Conclusion: Why POS Invoice Verification Is Non-Negotiable

POS invoice verification is the cornerstone of accurate financial management and tax compliance. With tools like FBR online, PRA verification, SRB verification, QR codes, and mobile apps, verifying invoices has never been easier.

Implementing robust verification routines:

- Prevents revenue leakage

- Improves inventory accuracy

- Builds customer trust

- Protects against fraud and penalties

Whether you’re a small retailer or a multi-location chain, investing in a POS system with strong invoice verification features ensures confidence, accuracy, and profitability.