Modern HP software is comprehensive and typically includes the following modules:

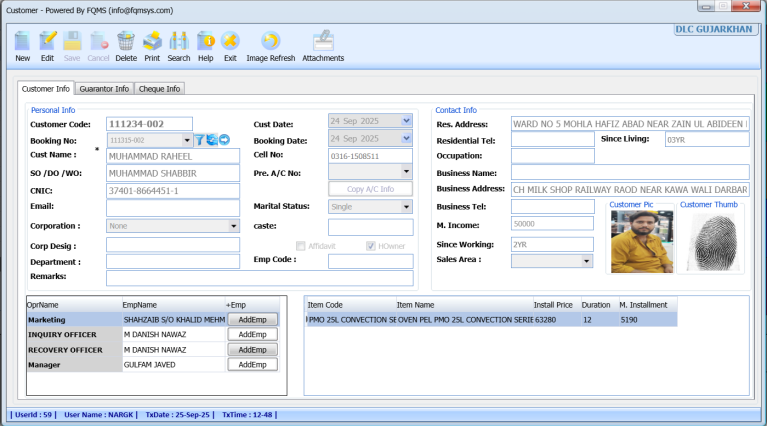

1. Customer & Agreement Management

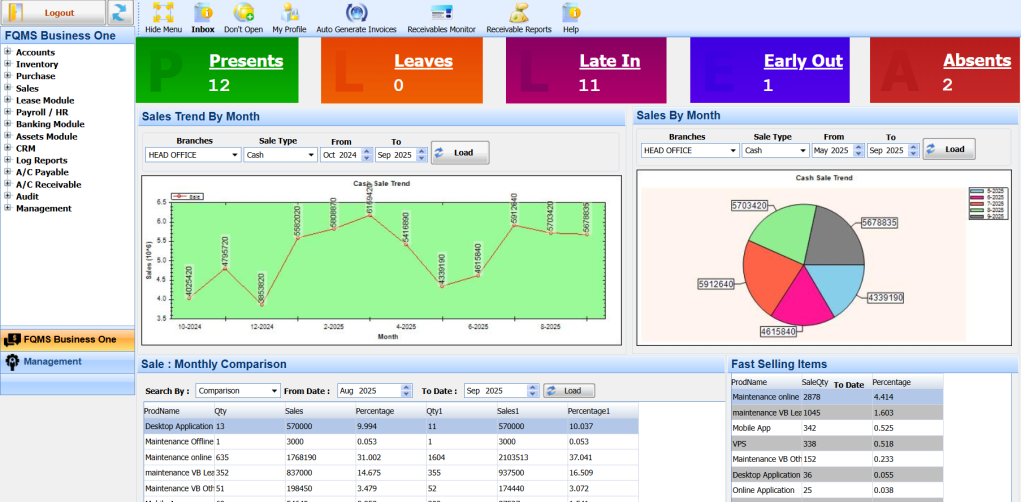

2. Accounting & Financial Management

3. Payment Processing & Collection

4. Asset & Security Management:

5. End-of-Term Management

6. Reporting and Analytics

7. Additional Advanced Features

8. Benefits of Using Hire Purchase Software