In the context of Pakistani business and taxation, FBR Integration refers to the process of connecting your software directly to the FBR’s systems via their published APIs (Application Programming Interfaces). This allows for the automated, real-time exchange of data, primarily for sales and purchase invoices to be reported directly to the FBR’s Real-Time Invoice Verification System (RTIVS).

This is a legal requirement under the Sales Tax Act, for registered persons.

Integrating with the FBR transforms your software from a simple record-keeping tool into an essential compliance engine. This is a powerful VAS because it:

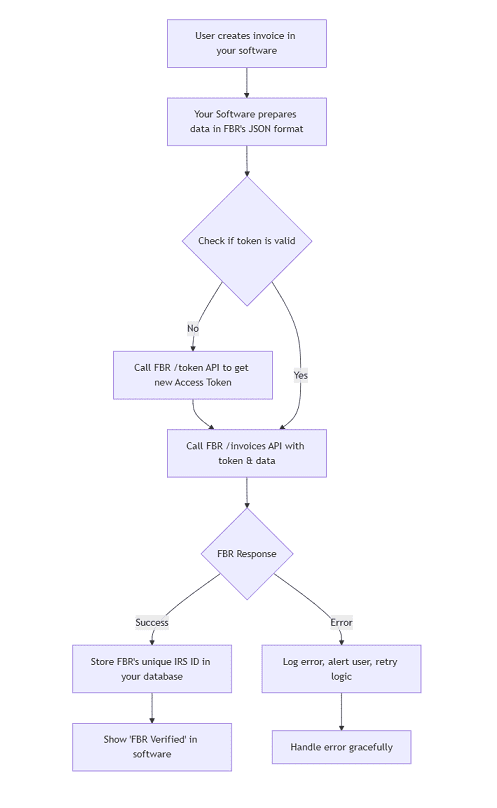

Here is a step-by-step guide to the integration details:

Once approved, FBR will provide you with critical security credentials. The most important ones are:

The integration typically follows a standard O Auth 2.0 client credentials flow for server-to-server communication. Here is the detailed sequence: